ID: 990214

SKU: 2.65E+11

Category: Computer software and drivers

Tags: 30days

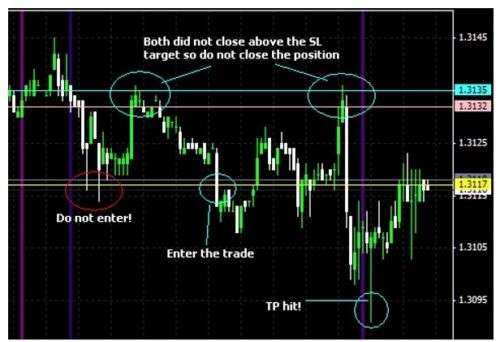

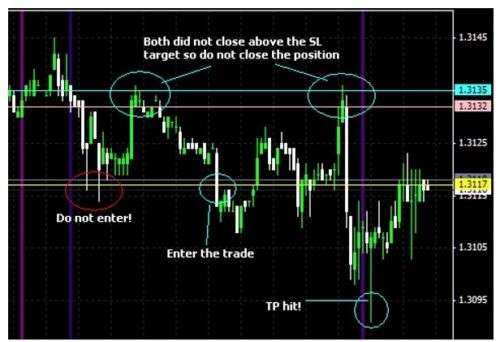

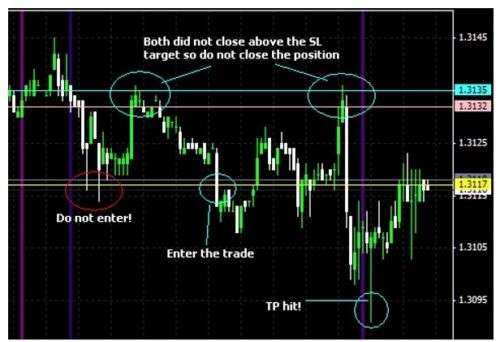

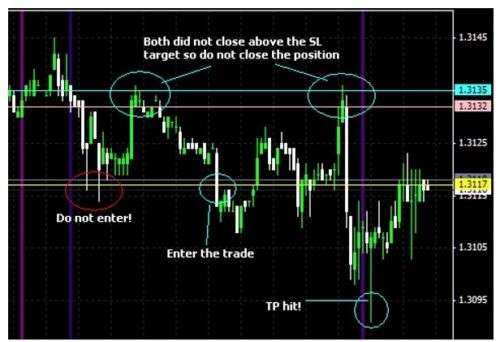

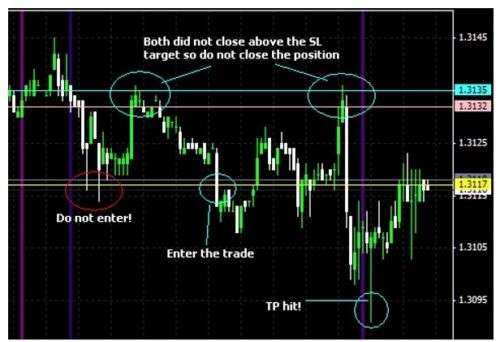

Forex DOSR Technique: Master Support and Resistance Trading with Daily Candle Analysis

About this item:

#NAME?

₹7191

On preorder

Delivered in 30-60 days

On Pre-Order

Guaranteed Secure

- Guaranteed delivery

- Fast shipping

- PAN India shipping

- 100% Secure payment

- Regular orders dispatch in 48 Hours

- Pre-orders dispatch in 30-45 days

- Returns accepted

- Fast refund process

- 24/7 customer support