ID: 992450

SKU: 2.05E+11

Category: Computer software and drivers

Tags: 30days

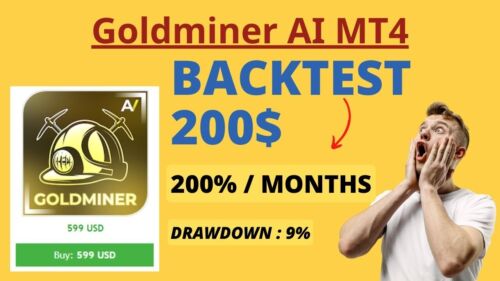

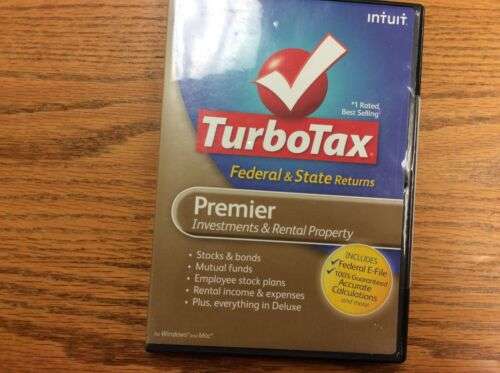

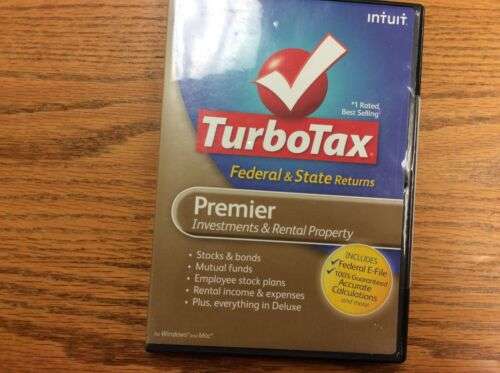

Unleash Your Financial Power: TurboTax Federal Premier 2009 for Comprehensive Tax Preparation and Real Estate Investment Management

About this item:

- Premier level tax software that includes features for investors and rental property owners - 2009 (latest) version - New sealed CD - Offers maximum deductions and credits - Easy to use

₹17091

On preorder

Delivered in 30-60 days

On Pre-Order

Guaranteed Secure

- Guaranteed delivery

- Fast shipping

- PAN India shipping

- 100% Secure payment

- Regular orders dispatch in 48 Hours

- Pre-orders dispatch in 30-45 days

- Returns accepted

- Fast refund process

- 24/7 customer support